SAD Management

Terms and conditions Shipping conditions Legal information

Terms and conditions Shipping conditions Legal information

The DUA is an essential document that must accompany the goods to comply with customs formalities in import and export operations outside the European Union, the Canary Islands, Ceuta and Melilla. This management is carried out by the post office and charges around 13.50 euros for it, but you can save this cost by managing the procedure yourself as we show you below.

VERY IMPORTANT: The DUA must be managed from the computer where you have the Digital Certificate installed.

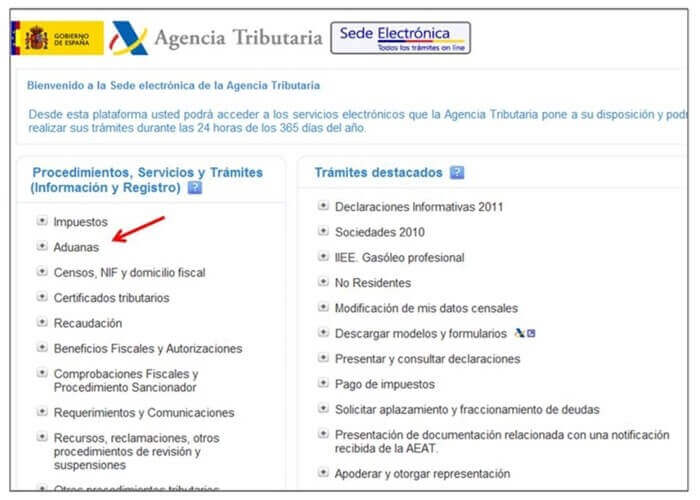

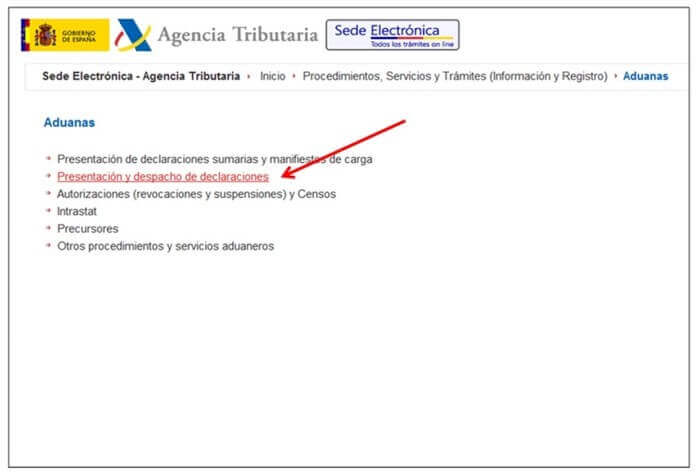

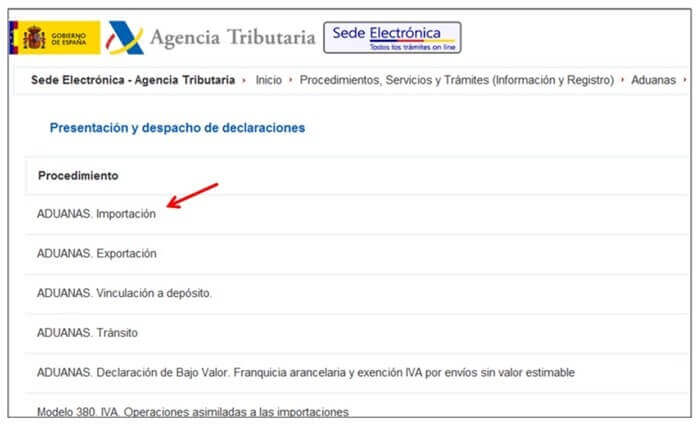

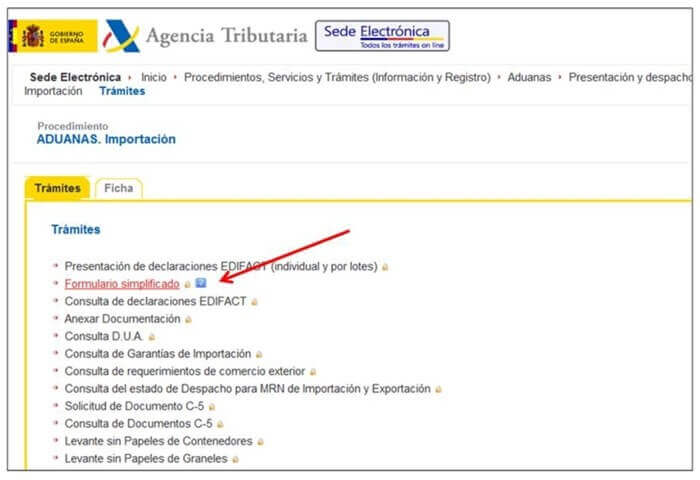

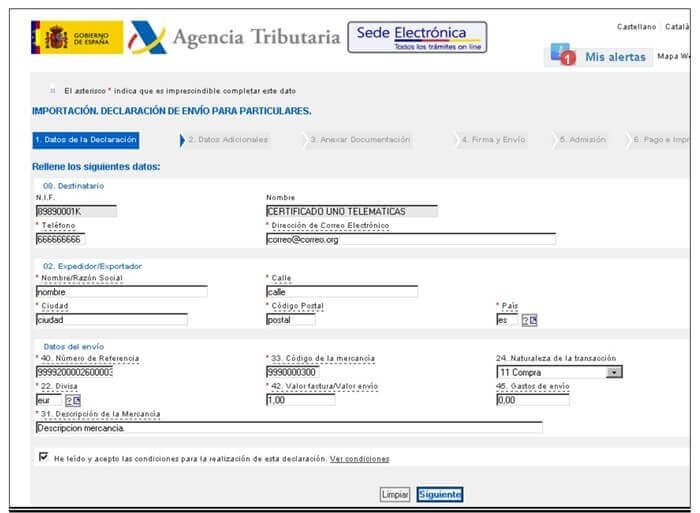

To access the form you have to enter the Electronic Office of the AEAT https://www.agenciatributaria.gob.es/ –> Procedures, Services and Paperwork –> Customs -> Presentation and dispatch of declarations –> Import –> Simplified Form.

The information that will appear in the identification of the interested party (NIF and name) will appear complemented automatically based on the information of the Digital Certificate with which it has been accessed. Hence the importance of the data of the person who buys matching the data of the Digital Certificate.

The interested party must indicate a contact telephone number and a valid email address. This address may be used by the AEAT to send information regarding this declaration.

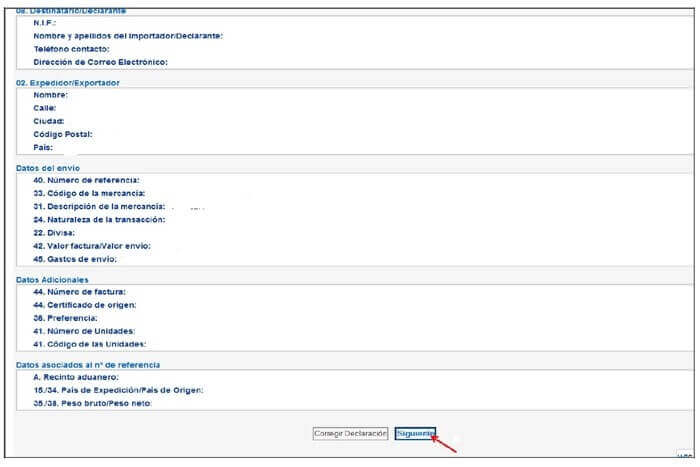

You must indicate the required data in relation to the sender of the shipment. In our case, these are the data from entreovejasyyo.com:

Dracena 12, 4B 28016 Madrid, Spain

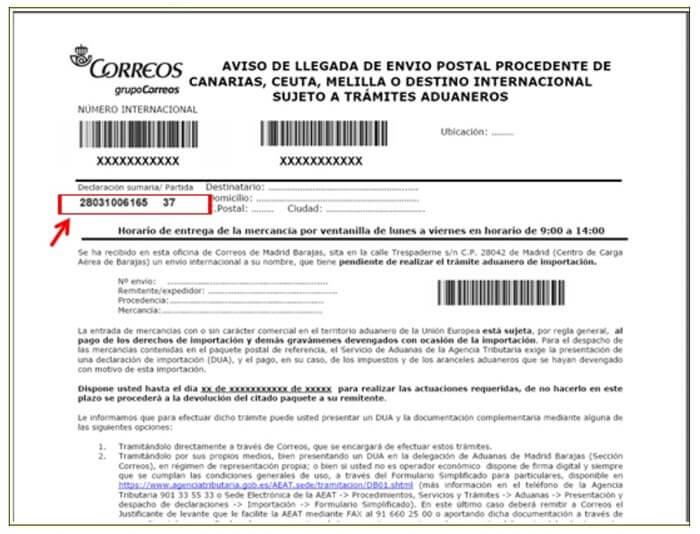

Reference number: You must put the number that has been provided by your shipping operator. If you do not know it, you must contact said operator. In the case of Correos, the reference number is the one that appears highlighted:

Reference code: The field will appear filled with the generic code of the merchandise 9990000300. However, if you know the specific tariff position of the merchandise, you can indicate it.

Nature of the transaction: You must choose from the dropdown if it is a purchase (code box 11) or a shipment between individuals (code box 99). In the case of purchases on entreovejasyyo.com, you must select “Purchase” (box code 11).

Currency: Indicate the currency key. In this case, euros €.

Invoice value: Indicates the amount invoiced corresponding to the purchase (DO NOT put the shipping costs here). If it were a shipment between individuals, which is not our case, the valuation of the goods should be indicated here.

Shipping costs: Shipping costs related to the transport of the purchase. This information appears on your entreovejasyyo.com purchase invoice.

Description of the merchandise: Description, understanding as such the name of the merchandise, in sufficiently clear terms for its identification and tariff classification. In the case of buying at entreovejasyyo.com, you can put: «Health, nutrition and beauty products».

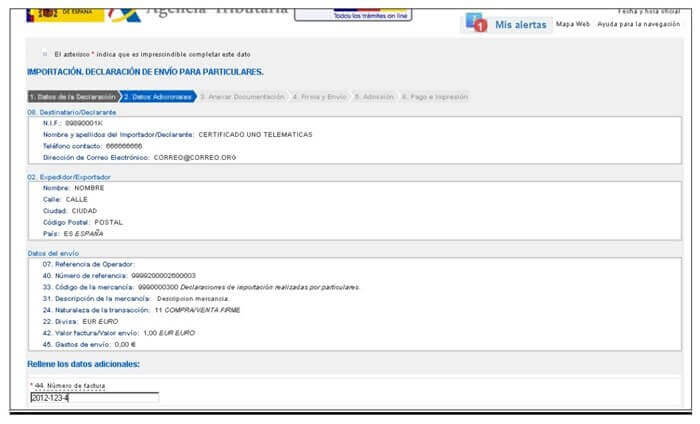

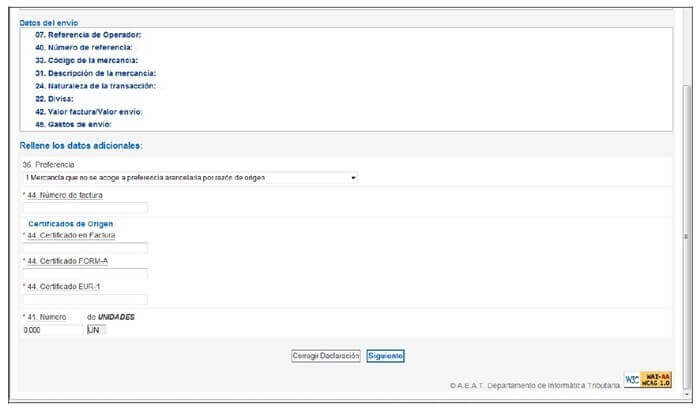

ADDITIONAL DATA:

Depending on the data that you have already indicated on the first screen, you will be asked to fill in a series of additional information. The data that may be requested are:

Commercial invoice number: This information appears on the invoice generated after the purchase at entreovejasyyo.com.

Preference: If you have indicated the specific tariff position of the merchandise, you must indicate in the “Merchandise that does not benefit from preference due to origin” drop-down menu.

In this section nothing else needs to be pointed out, in our case.

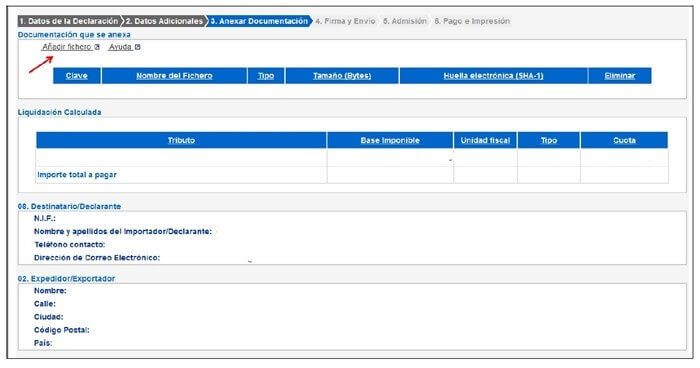

In this section, you have to attach the purchase invoice. You have it in your customer section of entreovejasyyo.com, in “history and details of my orders”. From there you can download it to your computer in PDF format and add it here. Once added, click “Next”.

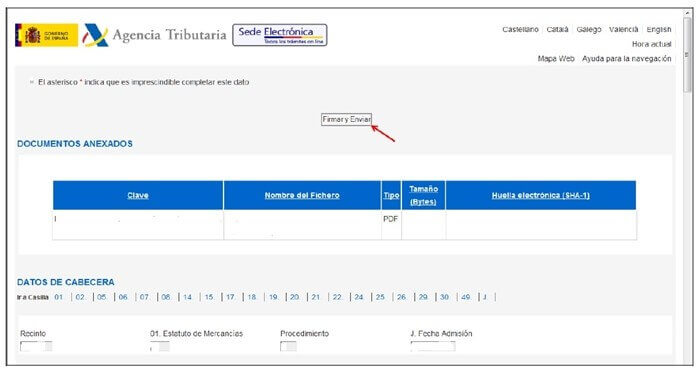

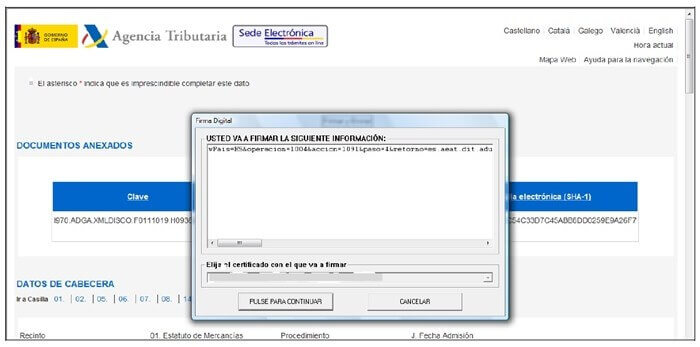

As it is a complete customs declaration that includes all the data referred to in the applicable DUA Resolution, you must sign and send the complete content of it. By signing and sending this declaration, you commit to the accuracy of the data sent, the authenticity of the documents presented and the fulfillment of all the obligations inherent to the inclusion of the goods in question. Likewise, it implies the obligation to pay the corresponding customs duties and the IGIC .

Here you will see a summary of the document and declaration sent as well as the circuit obtained by the declaration. If the circuit obtained is GREEN , you can proceed to pay the customs duties and the corresponding IGIC. Likewise, you are informed of the deadline to proceed with the payment. If the circuit obtained is ORANGE or RED , the customs will proceed, prior to the release of the goods, to verify the declared data, attached documentation and, where appropriate, to physical examination of the same. Normally, entreovejasyyo.com clients do not have any type of problem and the circuit is green.

You will see the amount you must pay and a link that takes you directly to the payment of the generated debt. (You can also pay it through the Detailed Consultation of the DUA = Electronic Office of the AEAT –> My Files –> Consultation of electronic documents)

It is recalled that from the moment in which the obligation to make a payment arises, You must pay the corresponding amount within the terms established by the regulations, 10 calendar days. The lack of payment, and justification of the same, within the aforementioned period will imply, in general, the cancellation of the declaration and the return of the purchase to the point of origin.

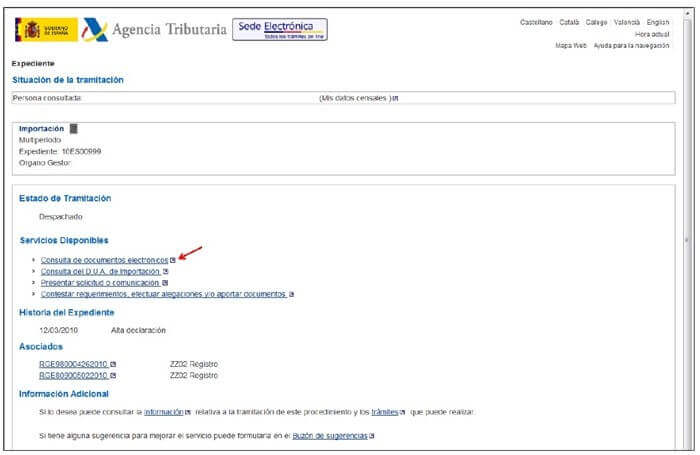

Once the payment has been made, you can now obtain proof of payment and release of the goods. To access the receipt, you can use any of the following routes:

Electronic Office of the AEAT https://www.agenciatributaria.gob.es/ –> Procedures, Services and Paperwork –> Customs -> Presentation and dispatch of declarations –> Import –> Consultation SAD –> My Files –> Consultation of electronic documents.

Electronic Office of the AEAT https://www.agenciatributaria.gob.es/ –> My files –> Consultation of electronic documents.

What happens in cases where the circuit assigned to the declaration is Orange or Red?

In these cases, the merchandise is retained by customs to check the declaration data and, where appropriate, carry out a physical examination of it. During these actions, customs may require you to provide certain documentation, which should be sent, preferably, through the option “Attach documentation” which is accessed from the detail of the declaration: Electronic Headquarters of the AEAT https://www.agenciatributaria.gob.es/ –> Procedures, Services and Paperwork –> Customs -> Presentation and dispatch of declarations –> Import –> Consult SAD.

Remember that, after attaching the documentation, you must press the action “request clearance” so that customs can receive it.

Contact us and we will help you with any question or problem with your order

© 2026 Entre ovejas y yo. All rights reserved.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!